Sycamore Partners Is in Talks to Acquire Walgreens

(Bloomberg) — Sycamore Partners is in talks to acquire struggling drugstore chain Walgreens Boots Alliance Inc., according to people familiar with the matter.

Most Read from Bloomberg

The New York-based private equity firm has been having ongoing discussions about a deal to take Walgreens private, said the people, who asked to not be identified because the details aren’t public. It’s possible discussions could fall through without a deal materializing, the people added.

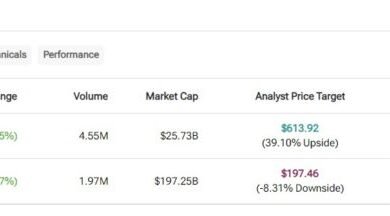

The stock jumped as much as 28% on the news, which was first reported by the Wall Street Journal. That was its biggest single-day gain since at least 1980. Walgreens shares had lost two-thirds of their value over the course of the year through Monday. That’s the worst performance of any stock in the S&P 500.

Representatives for Walgreens and Sycamore Partners declined to comment.

In October, the pharmacy chain said it would be closing some 1,200 outlets over the next three years after posting a $3 billion loss in the fourth quarter on charges related to opioid liabilities and the write-down of an investment in China. The company’s retail division has struggled amid the rise of online retailers like Amazon.com and discount giants Dollar General and Costco.

Walgreens has been a take-private candidate for years. KR & Co. formally approached the drugstore giant about a deal in 2019 in partnership with current chairman and biggest shareholder Stefano Pessina when the firm had a market value of $56 billion. Sycamore Partners has a history of acquiring retailers that have seen better times, including office supplier Staples Inc. and department-store chain Belk Inc.

–With assistance from Gillian Tan and Cynthia Koons.

(Updates with confirmation of talks in first paragraph, additional details throughout.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.