The Anatomy of Labor Demand Pre- and Post-COVID

Has labor demand changed since the COVID-19 pandemic? In this post, we leverage detailed data on the universe of U.S. online job listings to study the dynamics of labor demand pre- and post-COVID. We find that there has been a significant shift in listings out of the central cities and into the “fringe” portion of large metro areas, smaller metro areas, and rural areas. We also find a substantial decline in job listings in computer and mathematical and business and financial operations occupations, and a corresponding increase in job openings in sales, office and administrative support, food preparation, and especially healthcare occupations. These patterns (by geography and by occupation) are interconnected: the biggest declines in job listings by occupation occurred in the largest and densest geographies, and the strongest increases in job listings by occupation occurred in the smaller and less populated geographies.

Introduction

The COVID-19 pandemic brought about extreme dislocations in the economy, amid global supply chain disruptions, large demand and supply imbalances, and a shift to hybrid and remote work in many industries. The U.S. economy lost 22 million jobs from February to April 2020, and by the end of that year there were still 9 million fewer jobs than prior to the pandemic. By 2022, the unemployment rate had returned to pre-pandemic levels, and since then labor market conditions have been gradually normalizing.

Here we focus on labor demand and ask whether the pandemic has caused any systematic changes in its composition. We leverage detailed data on U.S. online job listings from Lightcast. These data are gathered from company career sites, national and local job boards, and job listing aggregators such as Indeed. With data on millions of job listings in each month, we can precisely document shifts in labor demand between the period leading up to the pandemic (2017-19), the reopening period following the short-term job losses of 2020 (2021‑22), and the period after the pandemic largely subsided (2023 to May 2024). We specifically look at the reallocation of labor demand along two key dimensions: population density and occupational categories.

Labor Demand Has Shifted Notably across Space

Recovery in the labor market has been uneven across geographies following the pandemic recession. The chart below shows the change in the shares of jobs listings across the three periods we consider for counties of varying population sizes. The shares for each period are constructed by taking the county in which each job was listed and aggregating these listings to four categories of county size using the National Center for Health Statistics’ (NCHS) classification scheme. The NCHS urban-rural classification includes four levels of county size: large central metros, large fringe metros, medium metros, and small metros and micropolitan areas.

Large Central Metros’ Share of Job Listings Have Fallen since the Start of the Pandemic

NCHS designation/proportion of job postings

The proportion of overall job listings originating from large central metros—counties with populations over one million at the center of a commuting area, such as New York City and Los Angeles—decreased from about 46 percent of all listings prior to the pandemic to about 38 percent of all active job listings in the post-pandemic period. In contrast, large fringe metros—counties with populations over one million that commute to a large central metro, like those surrounding Atlanta and Dallas—experienced relative stability in job listings. Farther out from these cities, the share of job listings in counties designated as medium metros, small metros, and micropolitan areas rose by about 7 percentage points compared to the pre-pandemic period. This significant shift highlights a reallocation of labor demand away from the largest urban centers toward smaller and more peripheral areas, possibly indicating a long-term transformation in the geographic distribution of jobs.

Labor Demand Has Also Shifted across Occupations

Besides the significant changes across space that we have documented, labor demand also exhibited substantial shifts across sectors between the pre- and post-pandemic periods. The chart below illustrates the changes in shares of job listings by occupation. We show this evolution for the six major occupation groups that experienced the largest shifts in labor demand over the course of the pandemic—representing about 55 percent of all listings.

Occupation Demand Shifts from Finance and Technology to Healthcare since the Start of the Pandemic

Sector/share of postings for selected occupations

As a share of all listings, job listings for computer and mathematical positions, such as software development, declined from 10.5 percent of all listings prior to the pandemic to 7.9 percent during the pandemic, and further dropped to 6.8 percent in the post-pandemic period. Similarly, roles in business and financial operations decreased from 8.4 percent of all listings to 7.4 percent during the pandemic. In contrast, healthcare listings, which primarily reflect listings for registered nurses, account for about 18.6 percent of all job listings in the post-pandemic period, up from 14.7 percent prior to the pandemic, indicating sustained demand for healthcare workers even after the peak of COVID-19.

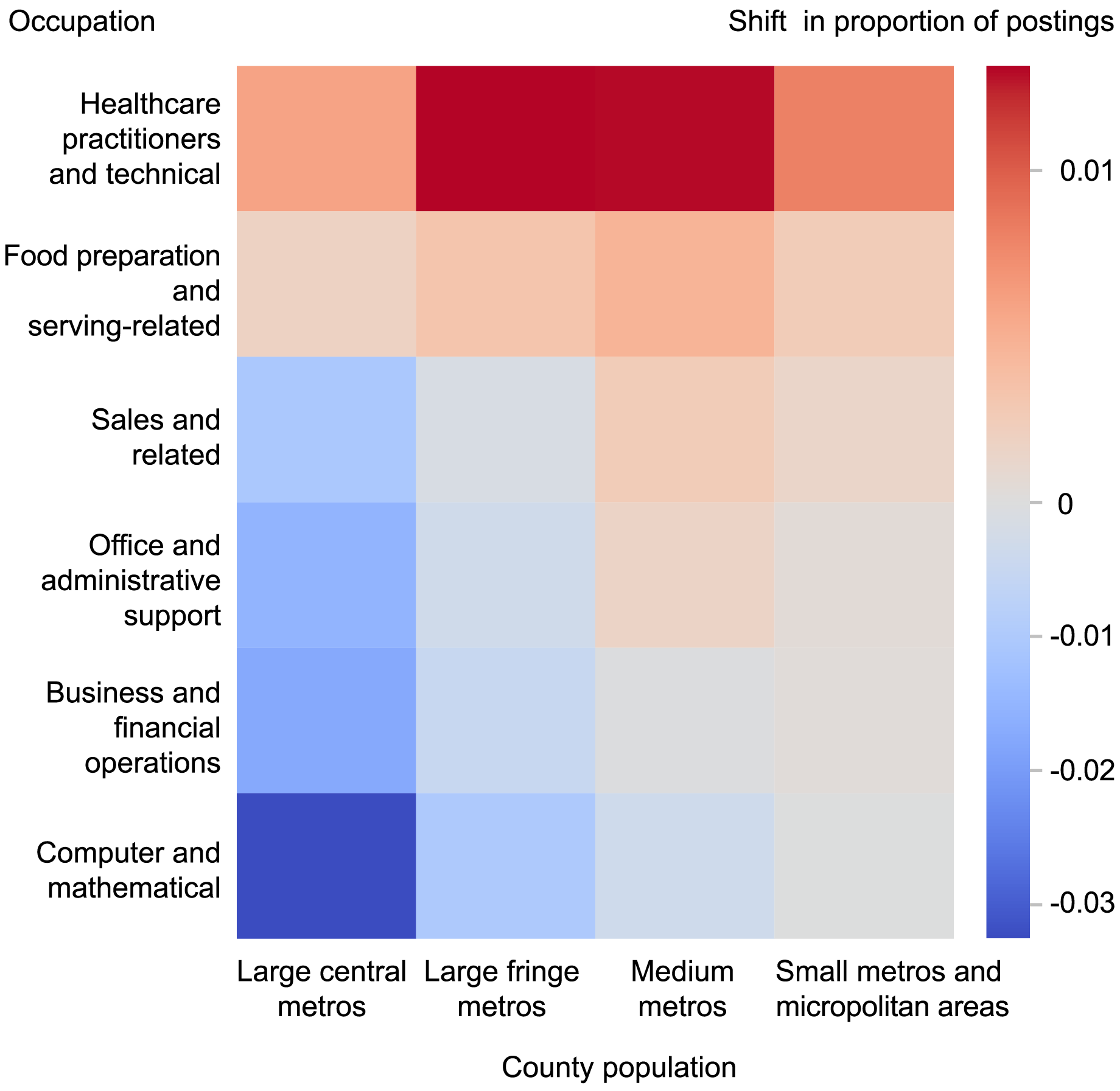

Occupational Shifts Exhibit a Clear Spatial Pattern

Importantly, shifts in labor demand across occupations appear to be correlated with the spatial changes we observed across geographies. In the chart below, the horizontal axis captures spatial shifts in job listings, while the vertical axis represents the sectoral shifts in listings of the six occupation groups that experienced the greatest change in demand following the pandemic. Each cell on this “heatmap” corresponds to a specific sector and spatial category. The color intensity of each cell represents the change in shares of overall job listings between the pre- and post-pandemic periods, with red indicating an increase in the share of jobs posted for a given sector and spatial combination, and blue indicating a decrease in the share of listings.

The Decrease in Demand for Computer and Math Roles Is Concentrated in Cities

Sources: Lightcast; Bureau of Labor Statistics; National Center for Health Statistics; authors’ calculations.

The heatmap suggests that decreased job listings for high-skilled workers in technology and financial roles is most concentrated in large cities and their commuting zones. In contrast, the uptick in the proportion of job listings for healthcare and food preparation workers is most concentrated outside of central metros, with the greatest increase in demand for these jobs coming from large fringe and medium metros. The loss in demand for high-skilled workers in the large central metros may be driven by the rise of remote work and shifting population dynamics, which have reduced the need for a spatially concentrated urban workforce. Similarly, the increase in demand for healthcare and services occupations outside of the central cities may be indicative of an urban to suburban/rural migration, with the influx of residents increasing the overall need for healthcare and food services.

Conclusion

In addition to its tragic human toll, the COVID-19 pandemic significantly disrupted labor markets, leading to shifts in labor demand that have not entirely reverted to pre-pandemic norms. Being four-and-a-half years out from the onset of the pandemic, this pattern suggests that many of these changes are here to stay.

Our analysis reveals that shifts in labor demand have occurred both across space and between occupations, with the two dimensions being interconnected. Declines in job listings for technology and financial roles have been most concentrated in dense urban areas, whereas the largest increase in listings has occurred in less populated counties and has been driven by demand for healthcare, food preparation, and retail positions. Such geographic shifts in labor demand may be consistent with changes in the patterns of population settlement, and the coinciding shifts in sectoral demand suggest a corresponding movement of economic activity. Understanding the drivers behind the reallocation of labor demand—and whether the shift is permanent—is an important topic for future research.

Richard Audoly is a research economist in Labor and Product Market Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Miles Guerin is an intern in the Federal Reserve Bank of New York’s Research and Statistics Group.

Giorgio Topa is an economic research advisor in Labor and Product Market Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Roshie Xing is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Richard Audoly, Miles Guerin, Giorgio Topa, and Roshie Xing, “The Anatomy of Labor Demand Pre‑ and Post‑COVID,” Federal Reserve Bank of New York Liberty Street Economics, August 7, 2024, https://libertystreeteconomics.newyorkfed.org/2024/08/the-anatomy-of-labor-demand-pre-and-post-covid/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).