Moderna, Bayer-backed Metagenomi stock drops 32% on Nasdaq debut

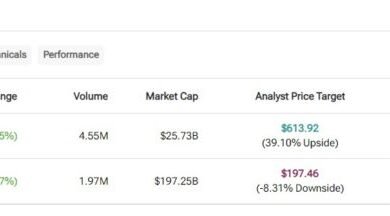

Feb 9 (Reuters) – Shares of Metagenomi Technologies , a genetic medicines company backed by Bayer Healthcare and Moderna, slumped 32% in their Nasdaq debut on Friday.

The stock opened for trading at $10.25 compared with the IPO price of $15 per share.

The lukewarm debut, which gives Metagenomi a valuation of $384 million, underscores the unpredictability young startups face as they seek stock listings.

The company, which is developing therapies for genetic diseases like hemophilia A, has yet to turn a profit. Its revenue has been generated from three collaboration agreements, including one with Moderna, and not from product sales.

Over the past two years, IPO investors have preferred to back profitable companies over growth-at-all-costs startups as the Federal Reserve has kept borrowing costs at record-high levels.

Even with increasing bets of a soft landing this year, the recovery in the IPO market has been uneven so far.

Among the healthcare and pharmaceutical-related firms that have been listed recently, CG Oncology and Kyverna Therapeutics have been received well, while BrightSpring Health Services has traded lower.

Metagenomi on Thursday priced its shares at the lower end of the $15 to $17 range it had marketed.

Last year, the company raised $275 million in a private funding round.

J.P.Morgan, Jefferies and TD Cowen are among the underwriters for the IPO.

(Reporting by Niket Nishant and Mehnaz Yasmin in Bengaluru; Editing by Tasim Zahid)