TikTok’s Planning to Boost its In-Stream Commerce Spend 10x in 2024

Will 2024 be the year that TikTok finally wins over Western consumers with its in-stream commerce options?

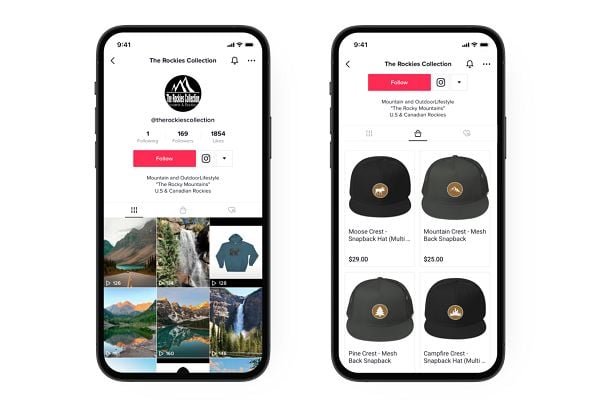

Over the last few years, TikTok has been pushing to maximize its in-app sales, in order to maximize its revenue opportunities. In China, the local version of the app, called Douyin, now generates the majority of its income via in-stream sales, which is the template that TikTok is looking to adapt for other markets.

But thus far, Western consumers have been far less enthused by in-stream shopping, forcing TikTok back to the drawing board after several failed starts.

But now, it’s set to make another push on eCommerce, with Bloomberg reporting that TikTok’s aiming to “grow the size of its US e-commerce business tenfold to as much as $17.5 billion this year”.

How it aims to do so, however, isn’t so clear.

The biggest driver of in-app shopping on Douyin is live-streams, with streaming commerce becoming a major industry in China. But again, Western audiences haven’t shown the same enthusiasm for impulse buying during live broadcasts.

That could reflect an overall hesitancy to buy on TikTok (amid concerns around its Chinese ownership), or it could be that live-streaming just hasn’t caught on in the same way, but its lack of traction isn’t exactly a great indicator for TikTok’s efforts.

Still, spending on TikTok, in general, is gaining traction.

Last month, data.ai reported that TikTok users spent $3.8 billion in the app throughout 2023, up 15% year-over-year.

U.S. consumers contributed a significant amount to that, though the majority of U.S. purchases have been on TikTok Coins, which enable users to purchase virtual gifts in the app, which can then be traded for real world currency.

So while U.S. users aren’t necessarily buying products via TikTok Shop, the fact that they are willing to spend in-app is a positive sign, which TikTok clearly sees as an opportunity for expansion.

So how will TikTok look to extend its shopping behaviors?

One option could be to incorporate food delivery, which has proven to be a winner on Douyin.

Douyin has also expanded into local services, assisted by its local content feed, which highlights videos from local users and businesses.

Starting with smaller-scale conveniences could help TikTok boost its utility, and get even more people spending in the app, in more ways, while it’s also been working to incorporate its own versions of Temu-like products in-stream.

Chinese retailer Temu has rapidly become a major force in Western markets, by offering sometimes lower-than-cost deals to lure consumers in. And while the products themselves are not always the highest quality, the thrill of shopping, without breaking the bank, has won over many, which TikTok is now also looking to tap into to extend shopping behaviors.

Because for TikTok, this is its key pathway to revenue success.

And not only for TikTok itself (and worth noting, TikTok is also increasing its merchant fees, beginning in April), but also for creators, who TikTok needs to get paid to keep them posting.

TikTok still doesn’t have a great revenue share process, with its Creator Fund becoming increasingly problematic, and ad share processes still not a viable option.

Commerce integrations provide more direct opportunity, both for influencers as salespeople, and as spokespeople for brands, and that could become a key lifeline for keeping its top creators posting more often, if it can convince more users to make direct purchases in-stream.

There are still a lot of questions, and a lot of ‘ifs’ in TikTok’s commerce calculations. But the opportunity is there, and if TikTok can convince more youngsters, in particular, to use it as a key product discovery and shopping platform, that could significantly solidify its business.

At the same time, you can expect Amazon’s spending on Washington-based lobbyists to increase in step with TikTok’s plans. If TikTok does succeed, the calls for a ban will ramp up once again.